If you had to bet on one thing to build lasting wealth, what would it be?

Stocks? Too volatile.

Gold? Appealing, but unpredictable.

A savings account? Let’s be honest—you're losing money to inflation.

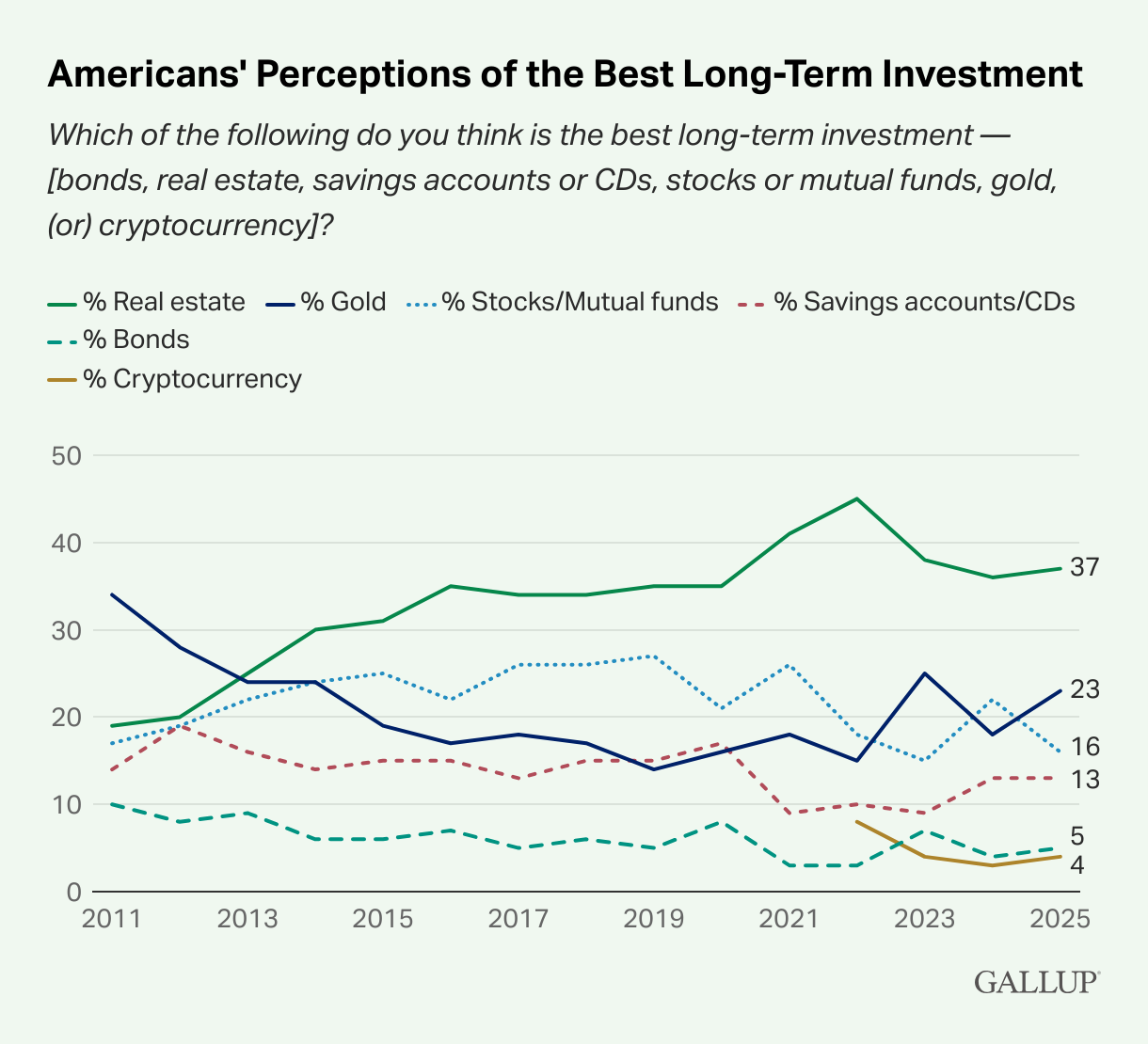

For 12 years running, Americans have answered that question loud and clear: real estate.

According to Gallup’s annual polls, real estate has consistently outperformed every other long-term investment—year after year. That’s not just a trend. That’s a message—real estate works. It’s reliable. It’s resilient, and it’s rooted in something tangible: a place to live, grow, or invest.

At Regan + Ferguson Group, we’ve seen it firsthand. Whether it’s a first-time homebuyer taking the first step toward equity or a seasoned investor expanding their portfolio, real estate continues to offer stability, long-term growth, and opportunity. While other investments can be unpredictable or passive, real estate offers something more grounded. It’s not just about financial return—it’s about owning something real that can serve multiple purposes over time.

Here’s why real estate continues to stand out:

1. It’s Tangible

Unlike paper assets, real estate is something you can live in, rent out, or renovate. It provides utility and value—right now and into the future.

2. It Appreciates Over Time—And You Can Use Leverage

While property values may fluctuate in the short term, the long-term trend is clear: real estate appreciates. And because buyers often finance with mortgages, you can build equity and returns without needing to pay the full price upfront.

3. There Are Real Tax Advantages

From mortgage interest deductions to depreciation and potential capital gains exclusions, real estate ownership comes with built-in tax benefits. These aren’t just perks—they’re well-established parts of the tax code designed to support property ownership.

4. It Can Generate Monthly Income

Real estate can do more than appreciate—it can provide consistent cash flow through long-term rentals, short-term stays, or creative strategies like house hacking. For many, this becomes a key part of their overall financial plan.

What We’re Seeing in Northeast Indiana

Locally, the demand for real estate remains strong. Inventory is still tight in many areas, which means well-priced homes don’t stay on the market for long.

We’re working with a wide range of clients—from those buying their first homes to investors focused on long-term growth. No matter the market conditions, we tailor our approach to help you make the most informed decision for your goals.

At Regan + Ferguson, we combine local knowledge with smart strategy and incomparable client service, helping clients navigate everything from interest rate changes to competitive bidding environments.

The Bottom Line: Real Estate Is a Long Game Worth Playing

Markets shift; trends come and go—but one thing remains constant: people will always need homes. If you’re thinking about buying, selling, or investing, now is a smart time to start the conversation. Because the next 12 years of growth? They begin with the decisions you make today.

Let’s talk about what’s possible—and build something that lasts. Reach out to the RFG today.